- Average 14K gold scrap price increased from approximately $42.08 in January to $67.26 in December 2025.

- This represents an estimated +60% year-over-year increase.

- Highest observed 14K offer: $75.01 (December, Cash for Gold USA).

- Lowest observed regular offer: $38.22 (January, LA Cash for Gold).

Read more

2025-08-06, Scrap stainless steel prices

Why Stainless Steel Scrap Prices Follow Nickel Market Trends

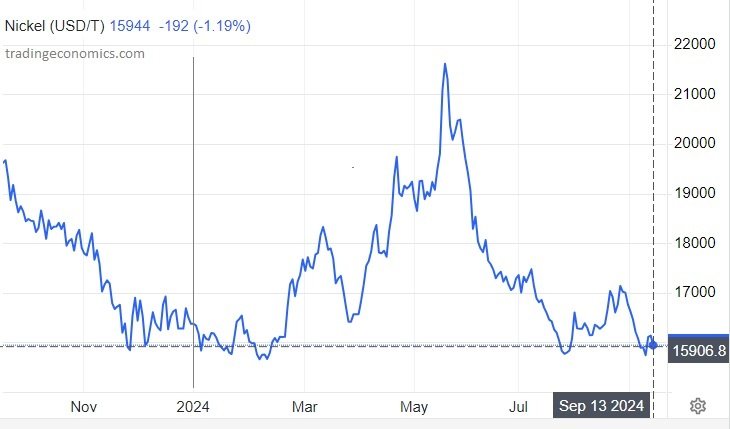

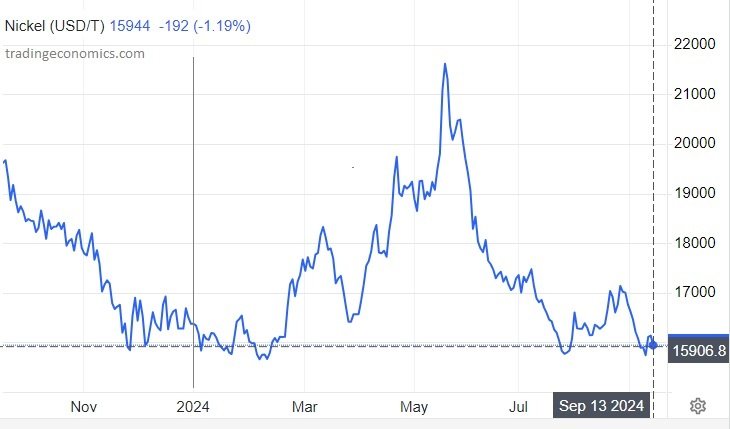

The provided chart shows that nickel prices have fluctuated significantly since fall 2024 — with noticeable peaks around October and March. However, during the first half of 2025, the overall trend has been slightly downward, stabilizing around $15,000 USD/ton.

Stainless steel scrap prices are closely tied to nickel trends. As nickel prices rise on the LME (London Metal Exchange), so does the value of stainless scrap. Alloys with higher nickel, chromium, or molybdenum content are generally valued more in the scrap market.

Read more

2025-06-05, Scrap Gold prices

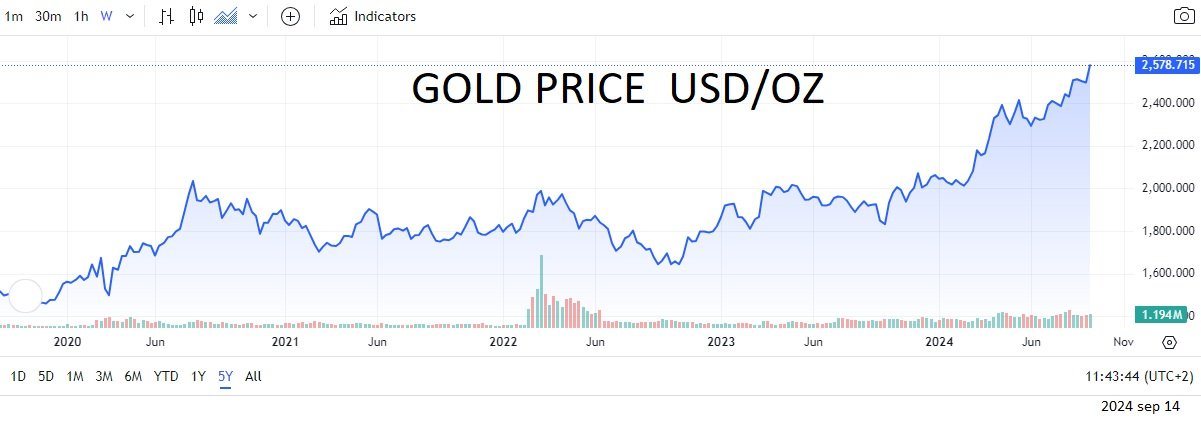

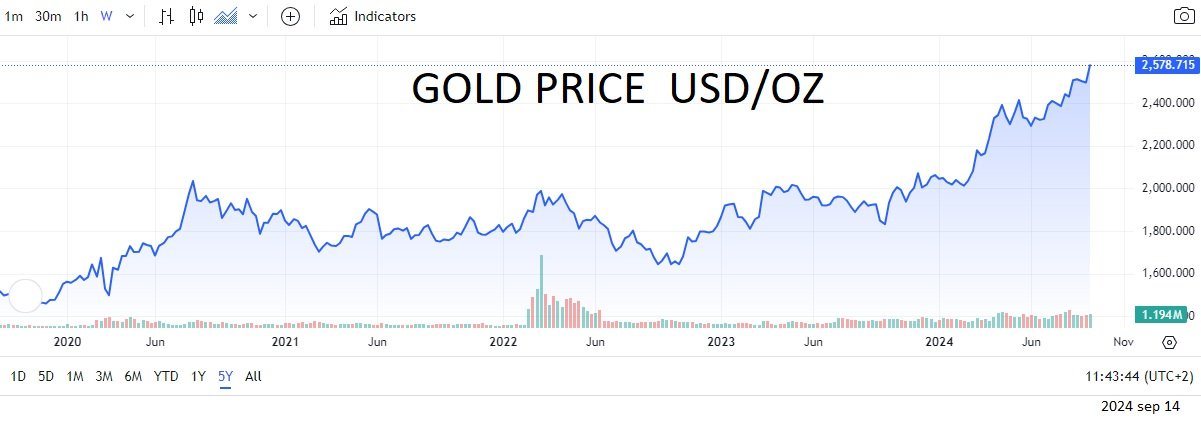

Since the beginning of 2025, the price of gold in the world has increased by about 20-30%, which has directly affected the purchase prices. If you have unused jewelry, now may be a good time to sell it, as buyers are offering much higher prices than a few months ago.

What are the current purchase prices for gold?

Based on scraprice.com data on gold purchase prices we present the prices of gold buyers in €/gr for 585 fineness (14 carat) gold from several countries:

(country, buyer, price, price fixing date)

USA (Cash for Gold USA) – €56.32/g (2025.05.08)

Czech Republic (Profihotovost) – €53.064/g (2025.06.02)

Poland (Artar S.C.) – €53.44/g (2025.05.11)

Read more

2025-04-08, Scrap copper prices

These days, there has been a sharp wave of copper price decline on exchanges, which is raising concerns throughout the production chain. By the end of March of 2025, the price level reached 5.2 USD/Lbs, but on April 8, this indicator fell by more than 20% to 4.1 USD/Lbs. Such a sharp drop reflects market instability, which is determined by both global economic changes and specific trends in raw material supply and demand.

A sharp drop in copper prices on metal exchanges will affect the price of copper scrap.

Copper scrap buyers who have copper scrap in their warehouses are unlikely to sell it and will try to hold on to it as much as their financial resources allow, while trying to purchase as much copper scrap as possible at a lower price.

Read more

2025-03-06, Scrap metal prices

Based on data provided by scraprice.com, this article reviews scrap metal price trends across various regions in the United States and the percentage changes recorded from December 2024 through February–March 2025. The data indicates that prices have steadily increased in most locations. These trends can be attributed to regional supply and demand fluctuations, transportation costs, and other market factors. Prices are listed in euros per ton (EUR/T).

Regional Analysis

Read more

2024-09-15, Scrap stainless steel prices

Stainless steel scrap price: Trends and influencing factors in 2024

Stainless steel scrap is an important category of secondary raw materials whose price and market trends can have a significant impact on both the industrial sector and individual sellers. In May 2024, the price of nickel on metal exchanges reached more than 21,550 USD/t. However, this wave of price increases was short-lived, and the price of nickel soon returned to its previous level. Since the price of stainless steel scrap is directly related to the price of nickel, the prices of this scrap have remained relatively stable.

Read more

2024-09-14, Scrap Gold prices

14 September 2024 has gone down in history as an important day in the gold market. On this day, the price of gold reached an all-time high of USD 2,580 per ounce. This event is undoubtedly pleasing for both gold investors and sellers, who can now look forward to greater financial gains.

Why has the Gold Price Risen?

There are several reasons for the rise in gold prices. Firstly, global economic turmoil and geopolitical strife often increase the demand for precious metals such as gold, which are considered a safe haven for investors. Secondly, global financial market volatility and fears of inflation can also contribute to the rise in gold prices.

Where to Sell Gold Most Expensive?

Read more

2024-06-30, Scrap aluminium prices

The price of aluminum scrap increased significantly during the first half of 2024. Compared to the beginning of the year, the price of aluminum on metal exchanges rose by about 30% by the end of May. On January 24, 2024, the price of aluminum was around 1970 euros per ton, and by May 29, it had reached as high as 2560 euros per ton. However, during June, the price of aluminum on exchanges decreased by about 12%, down to 2320 euros per ton.

Since aluminum scrap purchase prices directly depend on the price of this metal on the metal exchanges, they also changed accordingly. According to the information from the website scraprice.com, depending on the type of aluminum scrap, the highest purchase prices were recorded in Poland (about 2260 euros per ton) and Turkey (about 2200 euros per ton).

Read more

2024-04-22, Scrap copper prices

In the second half of April 2024, the price of copper rose to 9,749 US dollars per ton. This is the highest level of the copper price in the last two years. This impressive growth surprised both market participants and economic experts.

Compared to the beginning of the year, the price of copper increased by as much as 15 percent. This sudden rise in prices has created a lot of interest among investors and industry. Why did the price of copper rise so much?

One of the factors that could explain this increase in the price of copper is the recovery of the industry in recent years after the economic disruption caused by the pandemic.

Read more

1 - 10 / 46